Everything You Need To Know About Taxpayer Advance Loans¹ Join us on December 15th @ 1 pm EST to learn about Taxpayer Advance Options to grow your tax business! What you can expect: No-Cost² vs. Low-Cost Taxpayer Loans How and When to Request an Advance How to Market Taxpayer Advances ERO Financing Options ENROLL NOW! […]

How to help families decide

What’s best for them

Since its announcement, the Advance Child Tax Credit (ACTC), an expansion of the American Rescue Plan has created lots of headlines in the news. It may have even confused your customers into thinking that it’s another stimulus check.

Some families might be happy to receive $250 per month or more. While some might want to consider the impact of the child tax credit payments to their tax refund. In either case, the tax update has raised a lot of questions on both sides.

The second tax credit payment arrives on August 13. As a reminder, the first payment was issued by the IRS in your customers’ bank account or sent our by check on July 15. Since then, you’ve probably been asked many questions about ACTC.

Why stay enrolled? Or why unenroll or opt out from the child tax credit payments? Both are valid inquiries that deserve to be addressed.

Why unenroll or opt out from Child Tax Credit payments?

A full assessment of your customers’ financials will help determine if they should unenroll or opt out from the child tax child payments. Since you already know your customers and their financials, you can help them make the right financial decision. Helping your clients navigate this will improve your your relationships and attract new ones.

Reach out to your your customer base and have a conversation to find out if they are in one of the situations below:

- If their amount of taxes owed for this year could be greater than the expected tax refund. It’s important to highlight that The Child Tax Credit payments are only an advance from 2021 credits. This means that the amount of their refund may be either reduced or the amount of tax owed may increase.

- Their tax situation changed for a reason such as a divorce.

- Their household income has gone up, for reasons such as a new job.

- If any of their claimed dependent(s) on their 2020 tax return are aging out of the age 6 to 17 bracket before the end of 2021.

- Your customers prefers to receive their traditional lump sum for their 2021 tax refund.

Unenrollment can be done on the Child Tax Credit update portal. This action must be taken at least three days before the first Thursday of next month by 11:59 pm ET.

The unenrollment process may take up to seven calendars and it’s a one time action but re-enrollment is possible later . Please note, each spouse needs to unenroll, otherwise one spouse will get “half of the joint payment” according to the IRS.

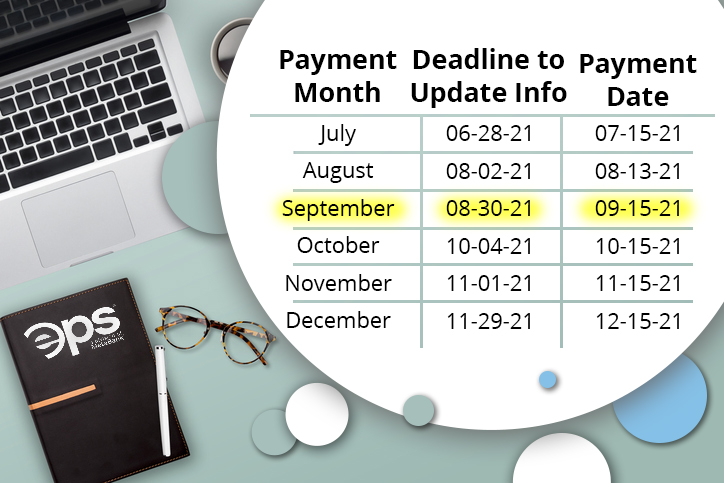

According to the IRS, the child tax credit payments are scheduled on the following dates:

Who should stay enrolled in the Child Tax Credit payments?

Your customers will receive the IRS child tax credit every month, until the end of the year. They can use the funds as they wish, for various purchases or personal plans. However, the credit is particularly helpful for low-income families that face economic hardship during the COVID-19 pandemic. The payments offers families another source of monthly income and peace of mind. It gives them the chance to better plan the funds in times of need and avoid harsh consequences.

How do you determine who qualifies for child tax credit payments?

The IRS considers families with CTC information on their 2019-2020 federal income tax return as qualified for the monthly payments.

At a closer look, the IRS toolkit explains precisely the criteria:

- Previously claimed a child: a son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half-brother, or half-sister.

- “The individual does not provide more than one-half of his or her own support during 2021.”

- A child lives with them for more than half of 2021.

- A child that will not turn 18 before Jan. 1, 2022.

- A dependent on their taxes.

- A U.S. citizen, U.S. national, or U.S. resident alien dependent.

- For those married and filing a joint return, they must have a main home in one of the 50 states or the District of Columbia for more than half the year.

Introduction to the Eligibility Assistant

Are your customers unsure if they qualify? You can direct them how to use the IRS Advance Child Tax Credit Eligibility Assistant to see if they qualify for Advance Child Tax Credit payments. The assistant will have them answer a few questions about their tax situation, including gross income and the number of children and their ages. Then, the tool will show them an estimated amount for each child under age 6 will and those with ages 6 to 17.

Visit the website and click “Manage advance payments” and a new page will open. Here they can update information or unenroll from the monthly payments.

Please know, that the amount showed on the portal is only an estimate. As a tax preparer, you can help families determine the exact amount of credit they will receive.

How to reach out to your customers proactively.

This is a great opportunity to build relationships and prove your expertise. Take it one step further and offer your customers child tax credit payment appointments. Use this time to go over financial information and help them choose the best option.

Even for customers that have already made a decision on their CTC payments, it’s a great opportunity to check in with them and help guide them if they’ve changed their minds.

If you have a social media page for your business, you can also post on a regular basis giving updates or reminding them that you are there to help.

If you need refresher, check our post about the ACTC basics.